1040 Form For Inmates

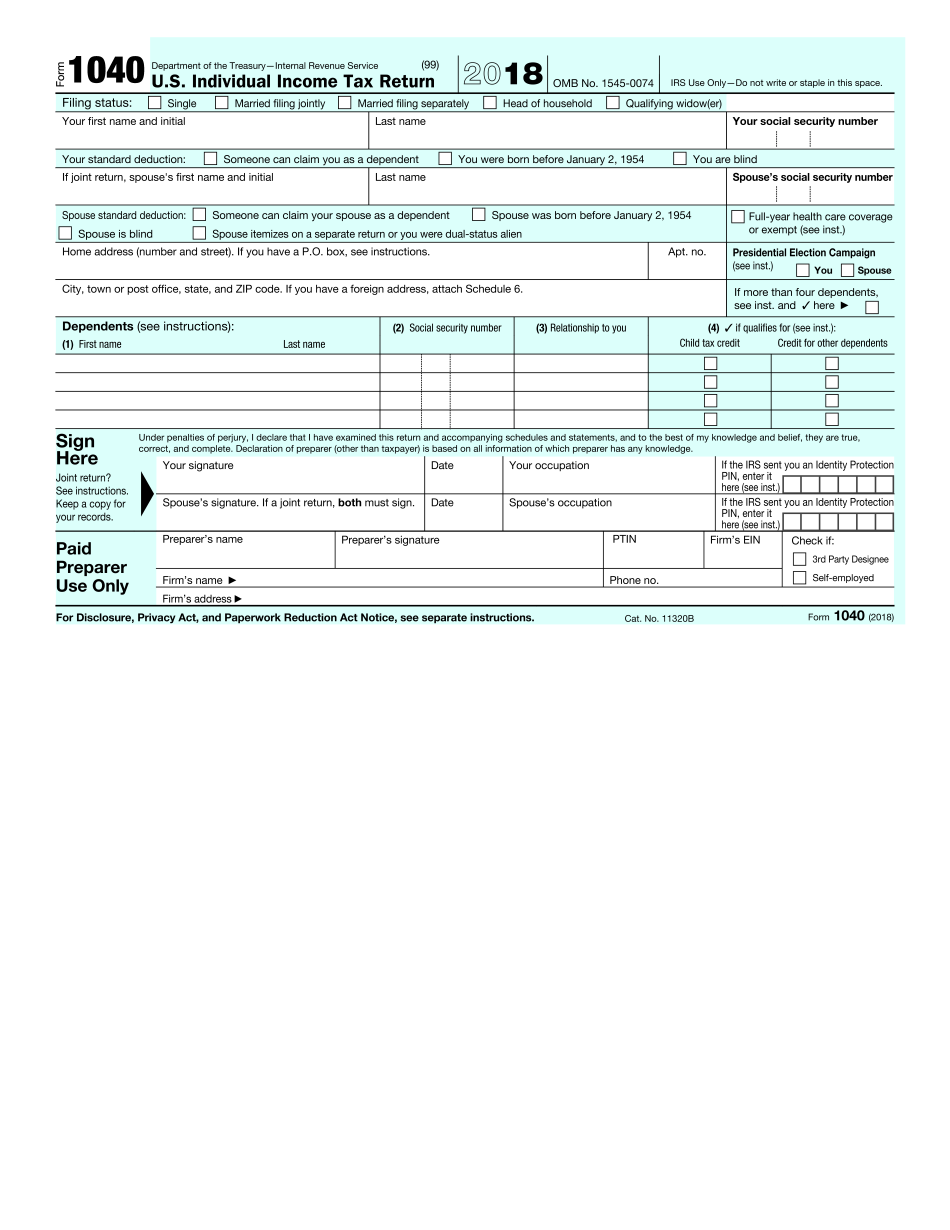

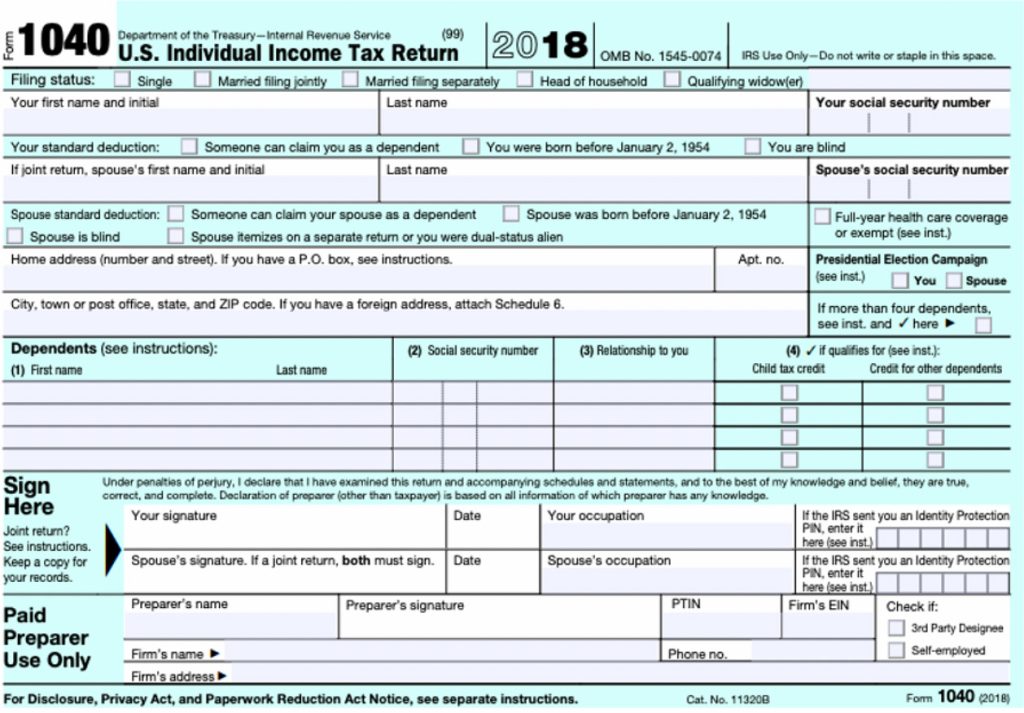

1040 Form For Inmates - Read the full story here. Web you must file this form by the regular tax deadline, which is april 18, 2023. Web a 1040 is a tax return. Once you have started a return for him here are some. The prisoner uses form 1040 like everyone else. Web use the address where he currently is at the time of filing, if that is the prison then enter the prisons address. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Congress passed the coronavirus aid, relief, and economic security act (“cares act”). Get the current filing year’s forms, instructions, and publications for free from the irs. If you are seeing pri printed next to form 1040 u.s.

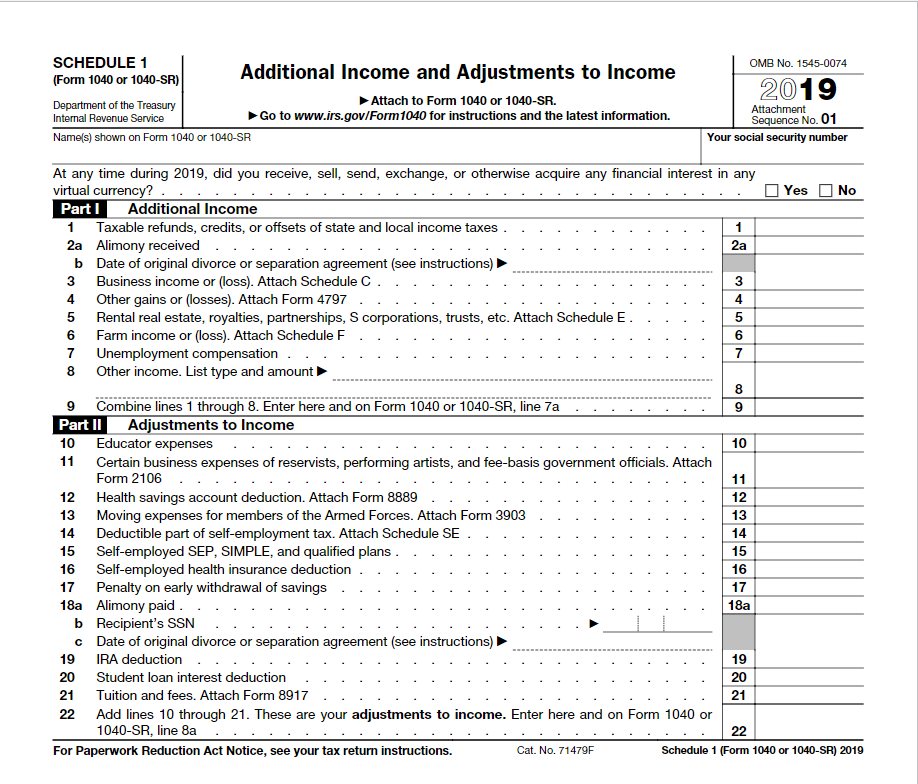

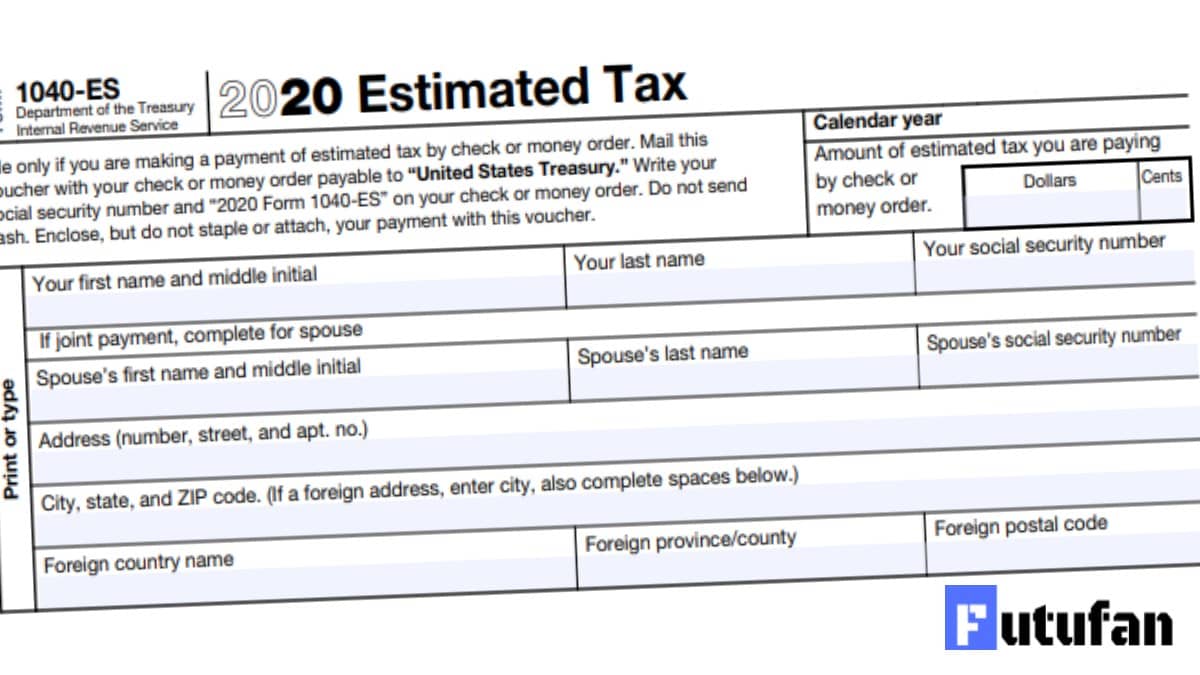

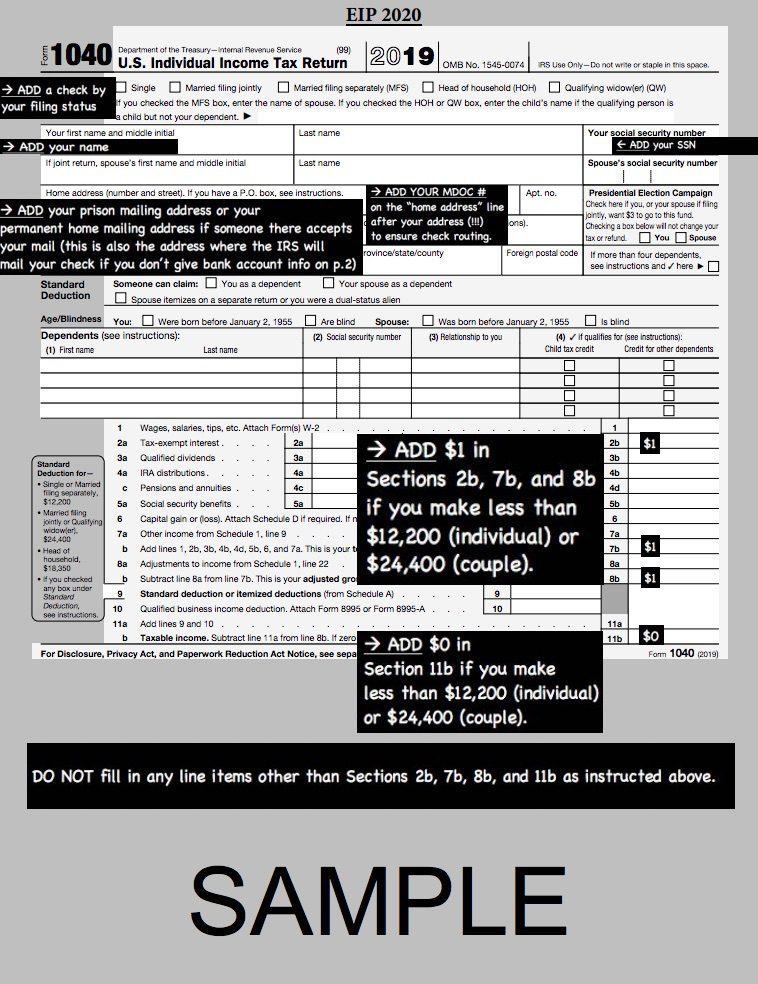

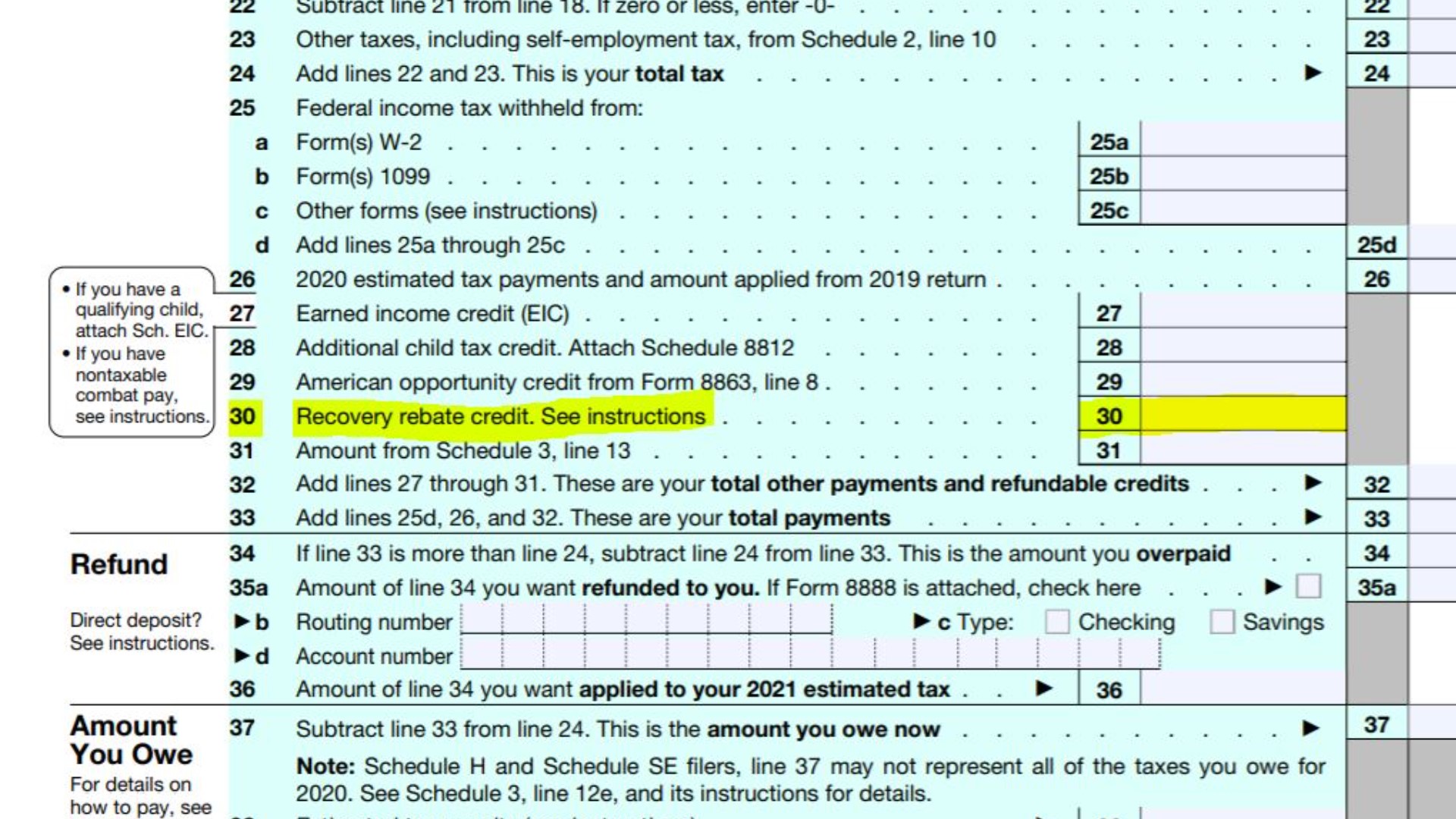

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web you must file this form by the regular tax deadline, which is april 18, 2023. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Complete, edit or print tax forms instantly. Form 1040 inmate mockup.pdf author: Congress passed the coronavirus aid, relief, and economic security act (“cares act”). The act provides a stimulus tax credit for eligible. Web people in prison who did not receive the stimulus payment (first or second) may be able to claim the payments by filling out a 1040 tax form and mailing it to the irs. Click here to download if the document isn't visible or.

Web popular forms & instructions; Get the current filing year’s forms, instructions, and publications for free from the irs. Web a 1040 is a tax return. Web the agency would also need to mail blank 1040 forms for inmates and instructions on how to fill out the paper return to ensure that every eligible person in each. Individual income tax return, series (including copies and unsigned returns), received from participating. If you are seeing pri printed next to form 1040 u.s. Read the full story here. Complete, edit or print tax forms instantly. Web (october 2020) in march 2020, the u.s. Order by phone at 1.

emeryuqmvuwgf emeryuqmvuwgf

Case managers will write on the form the offender’s name and doc id before giving it. Ad access irs tax forms. The act provides a stimulus tax credit for eligible. Individual income tax return, line 1, this is because you. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked.

PLEASE USE THIS INFORMATION TO FILL OUT 1) Indivi...

Web irs notice to incarcerated on how to fill out 1040 form to get a stimulus payment. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. If you are seeing pri printed next to form 1040 u.s. Complete, edit or print.

Taxation is not stealing Dangerous Intersection

The prisoner uses form 1040 like everyone else. Read the full story here. Web you must file this form by the regular tax deadline, which is april 18, 2023. Order by phone at 1. Individual income tax return, series (including copies and unsigned returns), received from participating.

IRS 1040 Form Fillable Printable In PDF 1040 Form Printable

Web use the address where he currently is at the time of filing, if that is the prison then enter the prisons address. If you are incarcerated for an extended amount of time: A 1095 is reporting health care insurance issued by a health insurance company. Web irs notice to incarcerated on how to fill out 1040 form to get.

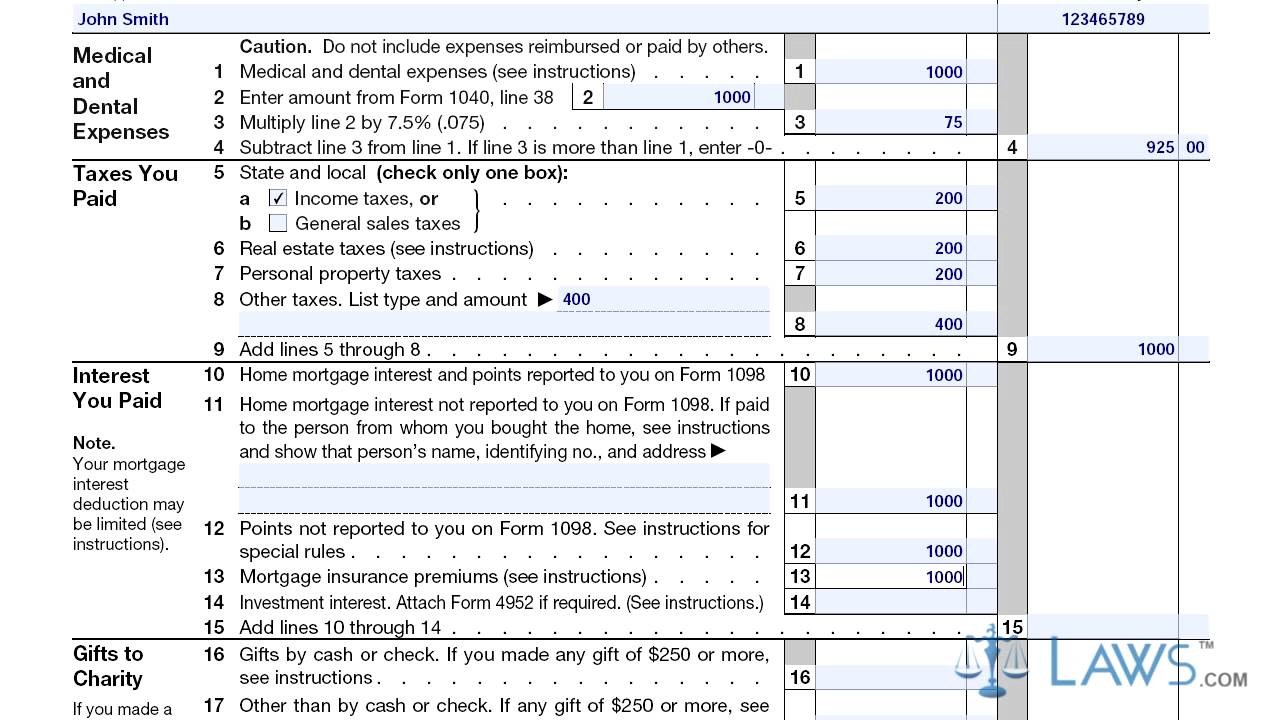

Itemized Deductions Form 1040 Schedule A YouTube

Web irs notice to incarcerated on how to fill out 1040 form to get a stimulus payment. Order by phone at 1. Read the full story here. Individual tax return form 1040 instructions; You have a couple of options.

1040ES Form 2023

Individual income tax return, series (including copies and unsigned returns), received from participating. If you are filing a joint return, your spouse must also sign. Congress passed the coronavirus aid, relief, and economic security act (“cares act”). Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

Mail Addressed to You Return Address IRS Article by Pearson & Co.

Get the current filing year’s forms, instructions, and publications for free from the irs. If you are filing a joint return, your spouse must also sign. Web the agency would also need to mail blank 1040 forms for inmates and instructions on how to fill out the paper return to ensure that every eligible person in each. Web a 1040.

Prisoners Stand To Receive Upwards of 2.6 Billion In Stimulus Payments

Get the current filing year’s forms, instructions, and publications for free from the irs. The act provides a stimulus tax credit for eligible. Complete, edit or print tax forms instantly. Order by phone at 1. Web get federal tax forms.

Didn't get your stimulus check? Claim it as an tax credit

Individual income tax return, line 1, this is because you. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Form 1040 inmate mockup.pdf author: The prisoner uses form 1040 like everyone else.

1040 Instructions Tax Return (United States) Internal Revenue Service

Web (october 2020) in march 2020, the u.s. Web the agency would also need to mail blank 1040 forms for inmates and instructions on how to fill out the paper return to ensure that every eligible person in each. Individual income tax return, line 1, this is because you. The act provides a stimulus tax credit for eligible. Get ready.

Evaluate The Inmate's Previous Living Situation To Determine Whether She.

A 1095 is reporting health care insurance issued by a health insurance company. Web you must file this form by the regular tax deadline, which is april 18, 2023. Read the full story here. If you are seeing pri printed next to form 1040 u.s.

Congress Passed The Coronavirus Aid, Relief, And Economic Security Act (“Cares Act”).

Click here to download if the document isn't visible or. If you are filing a joint return, your spouse must also sign. Web offenders can request a blank 2020 form 1040 from their case manager. Ad access irs tax forms.

Order By Phone At 1.

Form 1040 inmate mockup.pdf author: Complete, edit or print tax forms instantly. Web use the address where he currently is at the time of filing, if that is the prison then enter the prisons address. Form 1040x is not considered a valid return unless you sign it.

Web The Agency Would Also Need To Mail Blank 1040 Forms For Inmates And Instructions On How To Fill Out The Paper Return To Ensure That Every Eligible Person In Each.

Web (october 2020) in march 2020, the u.s. Web a 1040 is a tax return. Web get federal tax forms. Web people in prison who did not receive the stimulus payment (first or second) may be able to claim the payments by filling out a 1040 tax form and mailing it to the irs.