100 Es Form

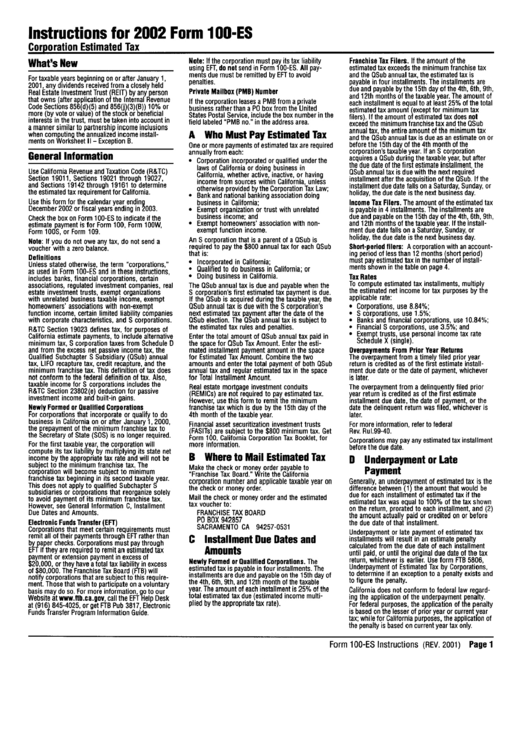

100 Es Form - If due date falls on weekend/holiday, see instructions. We last updated the school district estimated income tax payment voucher for individuals in. Return this form with a check or money order payable to: Edit your form 100 es 2019 online type text, add images, blackout confidential details, add comments, highlights and more. For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018. If no payment is due,. This form is for income earned in tax year 2022, with tax. Installment 1 due by the 15th day of 4th month of taxable year; Web use this form to file and pay estimated quarterly local school district taxes in ohio. If no payment is due,.

Web edit your 100 es form california online. Web january 15, 2023 2022 fourth quarter estimated tax payments due for individuals. Sign it in a few clicks. Web sd 100es 2022 school district estimated income tax worksheet (do not file) expected 2022 school district income tax base (see “school district income tax base” below). Choosing a legal specialist, creating a scheduled appointment and going to the office for a private conference makes doing a form 100 es. Web the following tips can help you complete 100 es instructions quickly and easily: This form is for income earned in tax year 2022, with tax. If no payment is due,. Get everything done in minutes. Edit your form 100 es 2019 online type text, add images, blackout confidential details, add comments, highlights and more.

Web use this form to file and pay estimated quarterly local school district taxes in ohio. For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018. Get everything done in minutes. Web follow the simple instructions below: Return this form with a check or money order payable to: Installment 1 due by the 15th day of 4th month of taxable year; Web edit your 100 es form california online. Choosing a legal specialist, creating a scheduled appointment and going to the office for a private conference makes doing a form 100 es. If due date falls on weekend/holiday, see instructions. Web sd 100es 2022 school district estimated income tax worksheet (do not file) expected 2022 school district income tax base (see “school district income tax base” below).

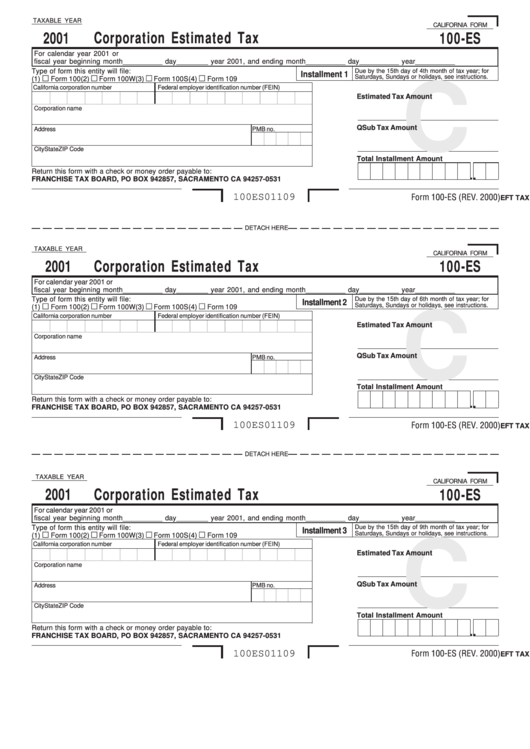

Form 100 Download Fillable PDF or Fill Online California Corporation

If due date falls on weekend/holiday, see instructions. For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018. Web follow the simple instructions below: Web edit your 100 es form california online. Edit your form 100 es 2019 online type text, add images, blackout confidential details,.

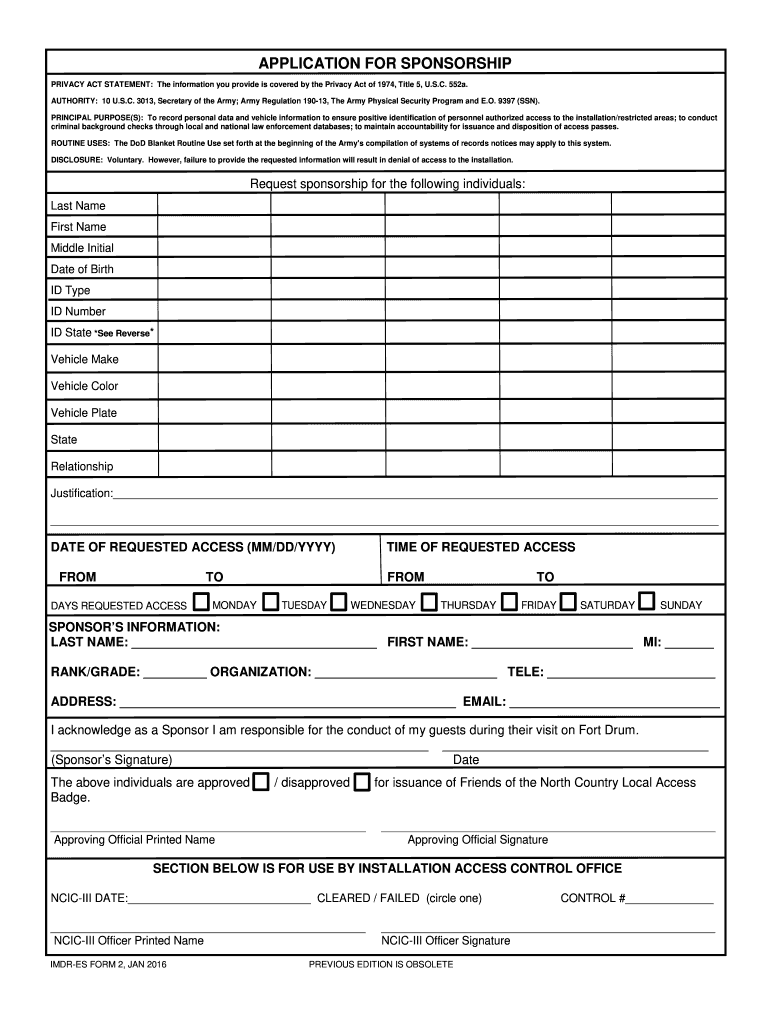

Imdr Es Form 2 Jan 2016 Fill Online, Printable, Fillable, Blank

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web the following tips can help you complete 100 es instructions quickly and easily: If due date falls on weekend/holiday, see instructions. Edit your form 100 es 2019 online type text, add images, blackout confidential details, add comments, highlights and more..

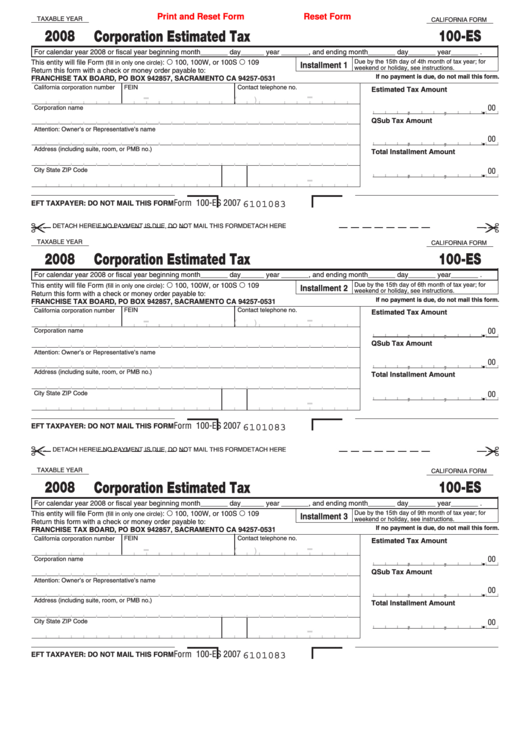

Fillable California Form 100Es Corporation Estimated Tax 2008

Get everything done in minutes. Web use this form to file and pay estimated quarterly local school district taxes in ohio. Web the following tips can help you complete 100 es instructions quickly and easily: Web see form it/sd 2210. We last updated the school district estimated income tax payment voucher for individuals in.

Verbs Base Form English Grammar iken ikenedu ikenApp YouTube

If due date falls on weekend/holiday, see instructions. Installment 1 due by the 15th day of 4th month of taxable year; We last updated the school district estimated income tax payment voucher for individuals in. Web edit your 100 es form california online. If due date falls on weekend/holiday, see instructions.

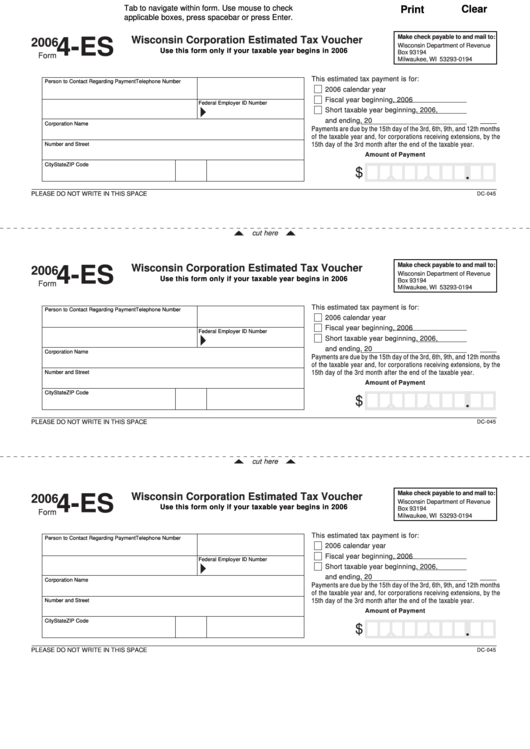

Fillable Form 4Es Wisconsin Corporation Estimated Tax Voucher

Sign it in a few clicks draw your signature, type. Choosing a legal specialist, creating a scheduled appointment and going to the office for a private conference makes doing a form 100 es. Web use this form to file and pay estimated quarterly local school district taxes in ohio. Web edit your 100 es form california online. Web see form.

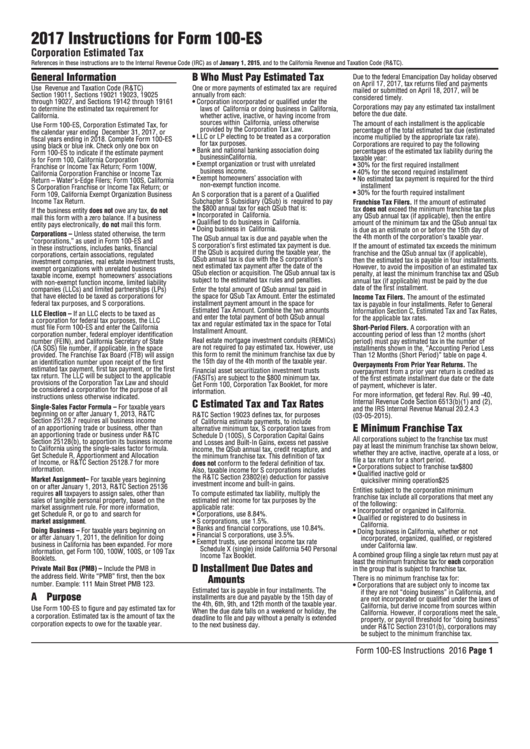

Instructions For Form 100Es Corporation Estimated Tax 2017 printable

If due date falls on weekend/holiday, see instructions. Sign it in a few clicks draw your signature, type. Installment 1 due by the 15th day of 4th month of taxable year; Web follow the simple instructions below: You can download or print current or past.

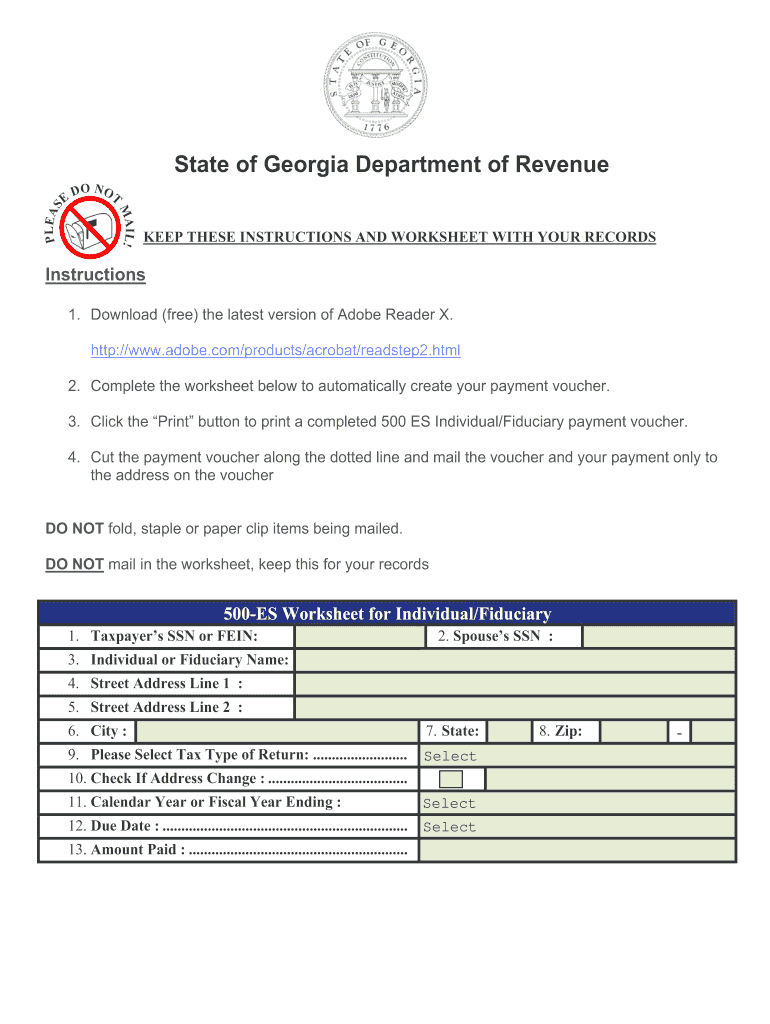

500 Es Form 2019 Fill and Sign Printable Template Online US

For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018. Web the following tips can help you complete 100 es instructions quickly and easily: You can download or print current or past. Choosing a legal specialist, creating a scheduled appointment and going to the office for.

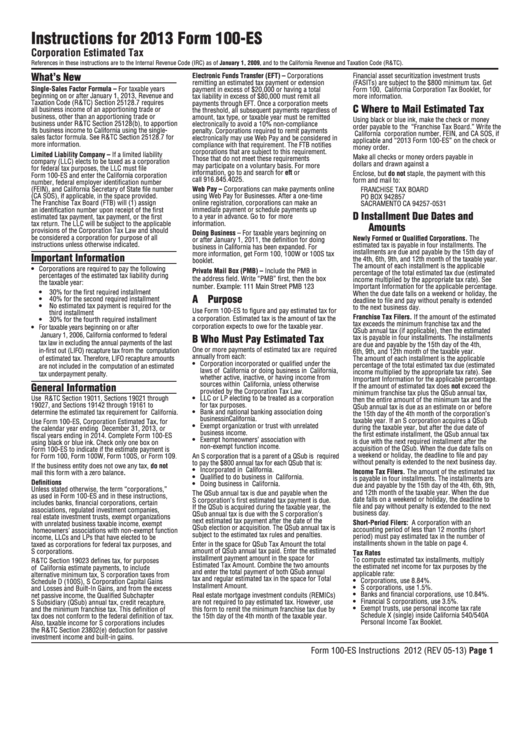

Instructions For Form 100Es Corporation Estimated Tax 2013

For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018. Installment 1 due by the 15th day of 4th month of taxable year; Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Type text, add images,.

Form 100Es Corporation Estimated Tax California printable pdf download

Choosing a legal specialist, creating a scheduled appointment and going to the office for a private conference makes doing a form 100 es. Web use this form to file and pay estimated quarterly local school district taxes in ohio. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. For calendar.

Web The Following Tips Can Help You Complete 100 Es Instructions Quickly And Easily:

Installment 1 due by the 15th day of 4th month of taxable year; Return this form with a check or money order payable to: Edit your form 100 es 2019 online type text, add images, blackout confidential details, add comments, highlights and more. Choosing a legal specialist, creating a scheduled appointment and going to the office for a private conference makes doing a form 100 es.

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

Web edit your 100 es form california online. Web see form it/sd 2210. If due date falls on weekend/holiday, see instructions. We last updated the school district estimated income tax payment voucher for individuals in.

Web Sd 100Es 2022 School District Estimated Income Tax Worksheet (Do Not File) Expected 2022 School District Income Tax Base (See “School District Income Tax Base” Below).

For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , for calendar year 2018. Due by the 15th day of 6th month of taxable year; If due date falls on weekend/holiday, see instructions. If no payment is due,.

Web Follow The Simple Instructions Below:

Web january 15, 2023 2022 fourth quarter estimated tax payments due for individuals. This form is for income earned in tax year 2022, with tax. Sign it in a few clicks draw your signature, type. Sign it in a few clicks.