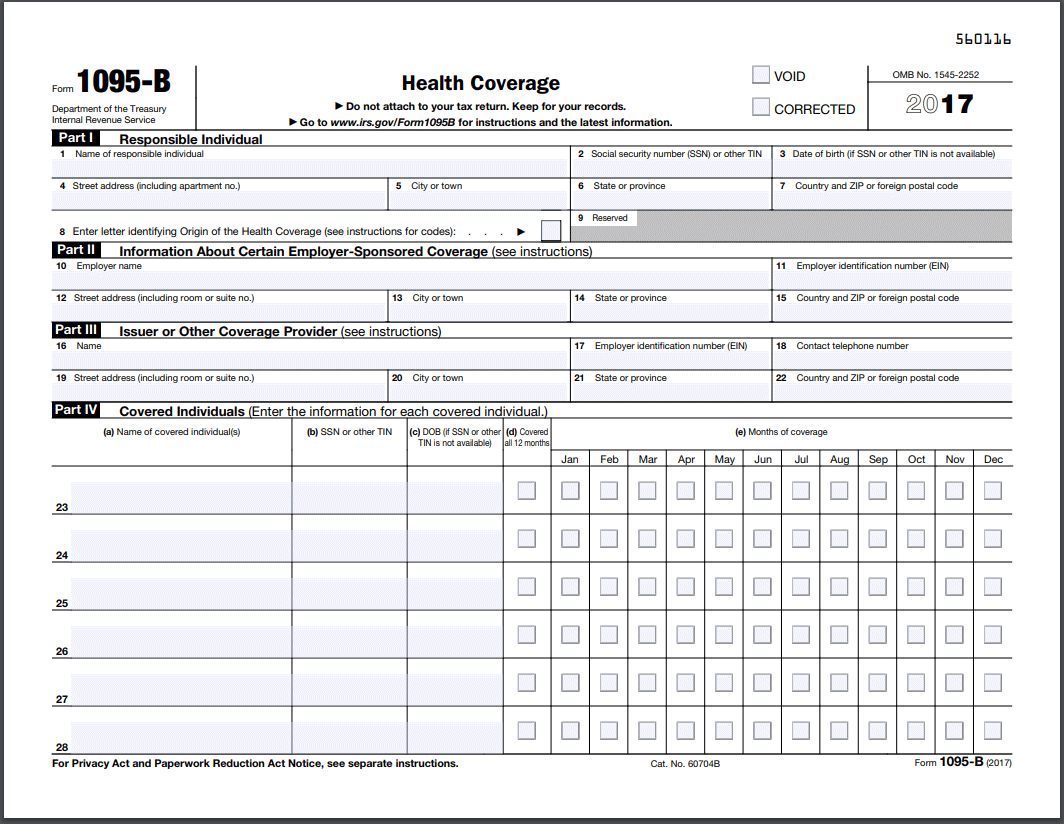

1095 -A Form

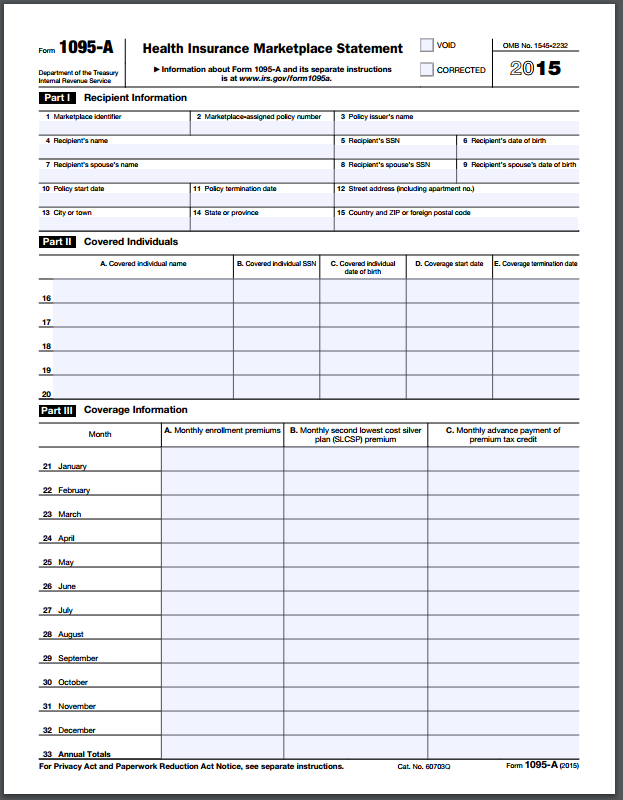

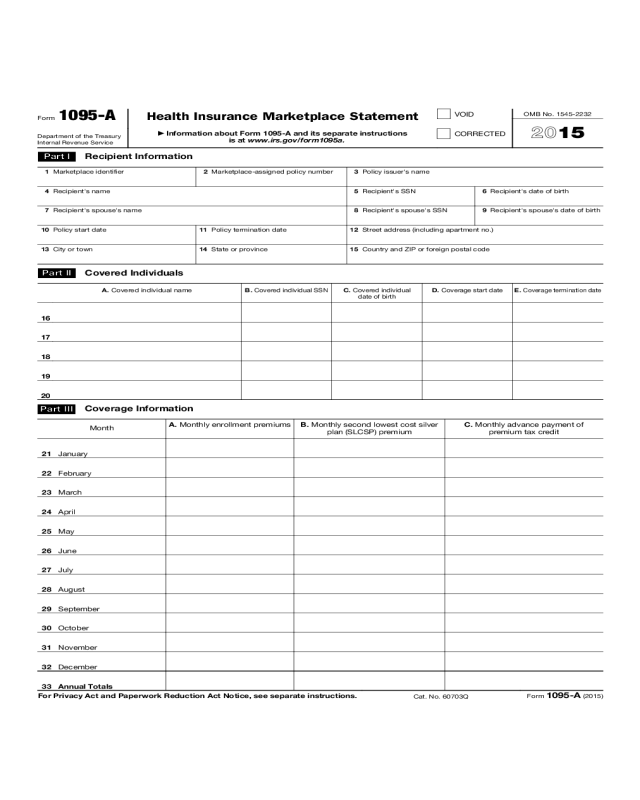

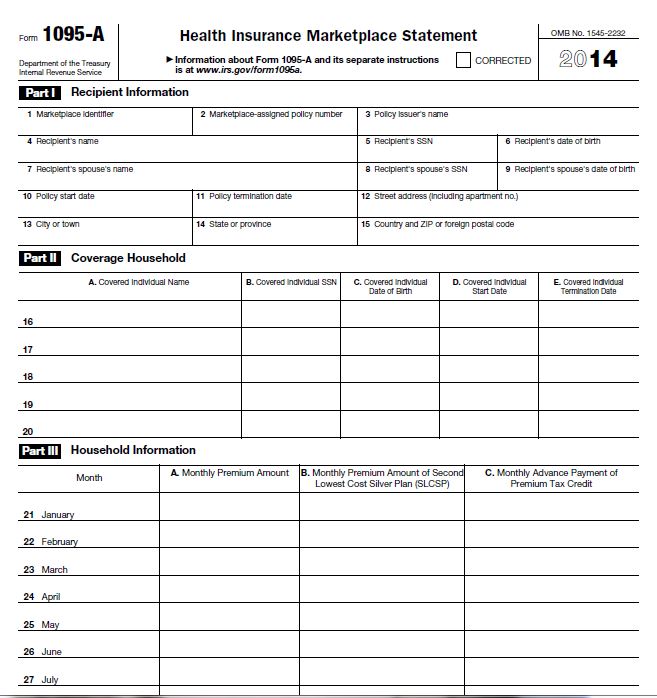

1095 -A Form - Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Step 2 under my applications & coverage, select your 2022 application — not your 2023 application. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. This information was also reported to the irs by the marketplace. It may be available online in your healthcare.gov account even sooner. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. Step 1 log into your marketplace account. The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. This form shows you details about health coverage that you or a family member may have received from the marketplace.

The form does not have to be returned to the government. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled. The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. Web what is a 1095a tax form? Step 1 log into your marketplace account. This will help you claim your premium tax credit benefits on your tax return. Which states do you assist? Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance.

The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Step 1 log into your marketplace account. This will help you claim your premium tax credit benefits on your tax return. The form does not have to be returned to the government. Web what is a 1095a tax form? Step 2 under my applications & coverage, select your 2022 application — not your 2023 application. This information was also reported to the irs by the marketplace. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Which states do you assist?

Form 1095A What It Is and How to Make Use of It? Life Insurance

The form does not have to be returned to the government. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14.

WHAT TO DO WITH FORM 1095A Insurance Information

Which states do you assist? Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web what is a 1095a tax form?.

Form 1095 A Sample amulette

Step 1 log into your marketplace account. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. Learn how to find it. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is.

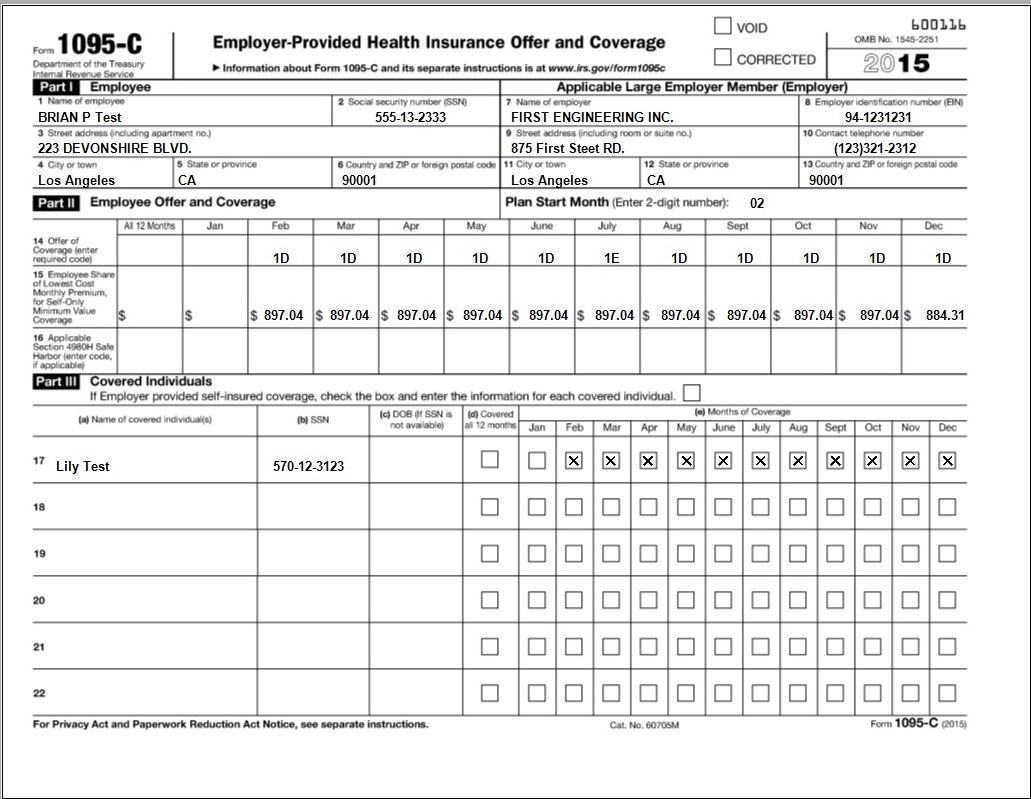

2015 1095 Tax Form 1095A, 1095B and 1095C Tax Filing

It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled. Web what is a 1095a tax form? This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. Note that this form.

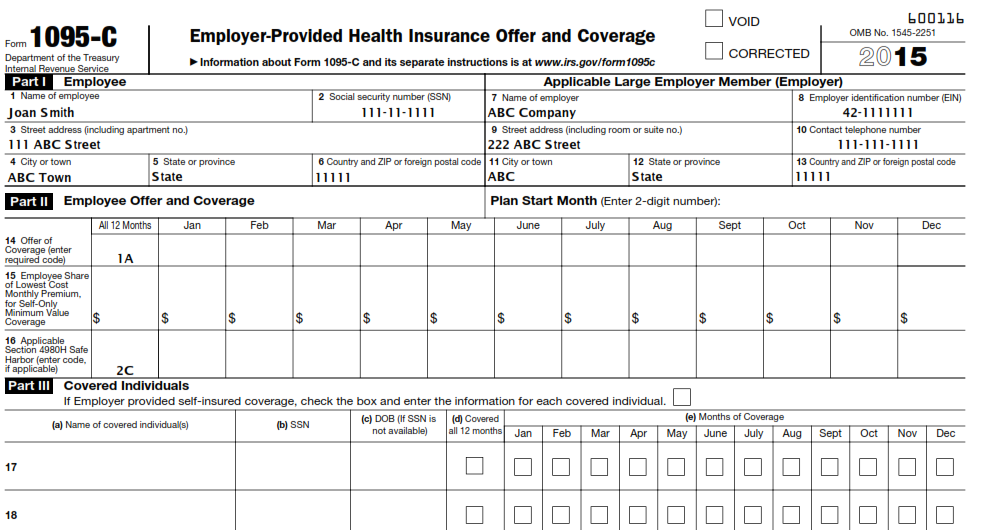

1095A, 1095B and 1095C What are they and what do I do with them

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. The affordable care act introduced premium tax credits to help lower the.

Form 1095A Health Insurance Marketplace Statement (2015) Edit

The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Step 1 log into your marketplace account. Which states do you assist? Note that this form comes from the marketplace, not the irs. Web information about form 8962, premium tax credit, including recent updates, related forms and.

1095A, 1095B and 1095C What are they and what do I do with them

Note that this form comes from the marketplace, not the irs. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. This.

New tax form coming for those enrolled in Obamacare during 2014 New

This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. This will help you claim your premium tax credit benefits on your tax return. Learn how to find it. It may be available online in your healthcare.gov account even sooner. Web information about.

Form 1095 A Sample amulette

This will help you claim your premium tax credit benefits on your tax return. It may be available online in your healthcare.gov account even sooner. This information was also reported to the irs by the marketplace. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Which.

Corrected Tax Form 1095A Katz Insurance Group

Learn how to find it. The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. Note that this form comes from the marketplace, not the irs. Web what is a 1095a tax form? Form 8962 is used either (1) to reconcile a premium tax.

This Form Shows You Details About Health Coverage That You Or A Family Member May Have Received From The Marketplace.

It may be available online in your healthcare.gov account even sooner. Learn how to find it. Step 1 log into your marketplace account. Note that this form comes from the marketplace, not the irs.

The Affordable Care Act Introduced Premium Tax Credits To Help Lower The Cost Of Health Insurance Purchased Through Healthcare.gov And The 14 States.

This information was also reported to the irs by the marketplace. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. The form does not have to be returned to the government. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file.

This Form Is Absolutely Required For Taxpayers Who Received Advance Payments Of The Premium Tax Credit (Aptc) To Help Pay For Health Insurance Coverage During The Year.

The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. Which states do you assist? Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. Web what is a 1095a tax form?

It Reconciles The Advance Payments Of The Premium Tax Credit Received If Any, And The Credit To Which The Taxpayer Is Entitled.

Step 2 under my applications & coverage, select your 2022 application — not your 2023 application. This will help you claim your premium tax credit benefits on your tax return.